Oh My!

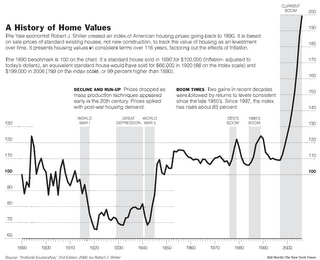

Above is a graphical illustration of housing values going back to 1890. It was produced by Yale economist Robert Shiller. This is scary stuff.

On a personal note, this past weekend I was hanging out with Bert for a night of insightful discussions and inebriated revelry. Instead, I was sobered by the economic predicament another old friend of ours currently finds himself in.

You see, my friend, I'll call him Big Bird, is currently in a situation many Americans currently find themselves in. He has a mortgage on their family home that has a variable rate component. As interest rates increase his monthly mortgage payments increase.

Furthermore, like many Californians, he owns several income producing homes that are currently in the same predicament. Rising interest rates that mean higher monthly payments. To make matters worse, the monthly payments are at a point where he consistently has to "feed" the assets. In other words, his monthly collected rent no longer covers his monthly mortgage payments (this does not include property taxes, insurance fees, etc.). So, Big Bird has to take money out of his salary or savings to cover the remaining expenses.

All the while, Big Bird refuses to accept the reality of the situation. He refuses to accept that the market could ever go down. He refuses to accept that he could lose it all. Big Bird rationalizes that "feeding" his assets is good since he is building equity. Afterall, isn't that the ultimate goal?

I aint so sure.

When I first graduated from College in the mid-90's I went to work for a small boutique commercial brokerage firm who I interned with while in college. Our main business was the sale of apartment complexes in California, and our inventory were foreclosed apartments direct from the banks. As you may recall, this was in the midst of the California real estate recession and apartment foreclosures were everywhere. I remember pitching apartment opportunities in San Diego and Orange County for as low as $20,000.00 to $30,000.00 per apartment unit. In today's' market those same assets could sell from $80,000.00 to $150,000.00, depending on the location.

Now, you might be saying, "that sounds like a slam dunk investment!" And you know what, it certainly was in retrospect. Unfortunately, hindsight is 20/20. Buyers for foreclosed assets in the mid-90's were difficult to find. A majority of investors, at that time, had been turned off by the market- i.e. had reached a level of market capitulation. No one wanted to buy income producing properties.

I remember calling prospective future owners about a great 45 unit opportunity in Santa Ana or Huntington Beach only to hear story after story about how they had lost their buildings to foreclosure. Each person had a different twist to their situation, but they all seemed to have similar components. All of the owners hurt by the market had, at one time, to "feed" their assets. Furthermore, they all reasoned that the market would never crash and that the extra money they put in would benefit them since it was building their equity.

Of course, this is all hog wash. When an investment no longer cash flows it is incumbent on the owner to make changes to alleviate the problem. If those changes are not effective it is important for an investor to learn to walk away or sell. In other words, when the signs become obvious it is time to reevaluate, reposition and run.

My early days of phone solicitation was a very early lesson in how I should approach my future investments. I have not forgotten those early lessons. I am hopeful that my friend Big Bird follows my advice, takes it in the gut and learns to walk away.

Hat Tip: Atrios: Link Here:

0 Comments:

Post a Comment

<< Home